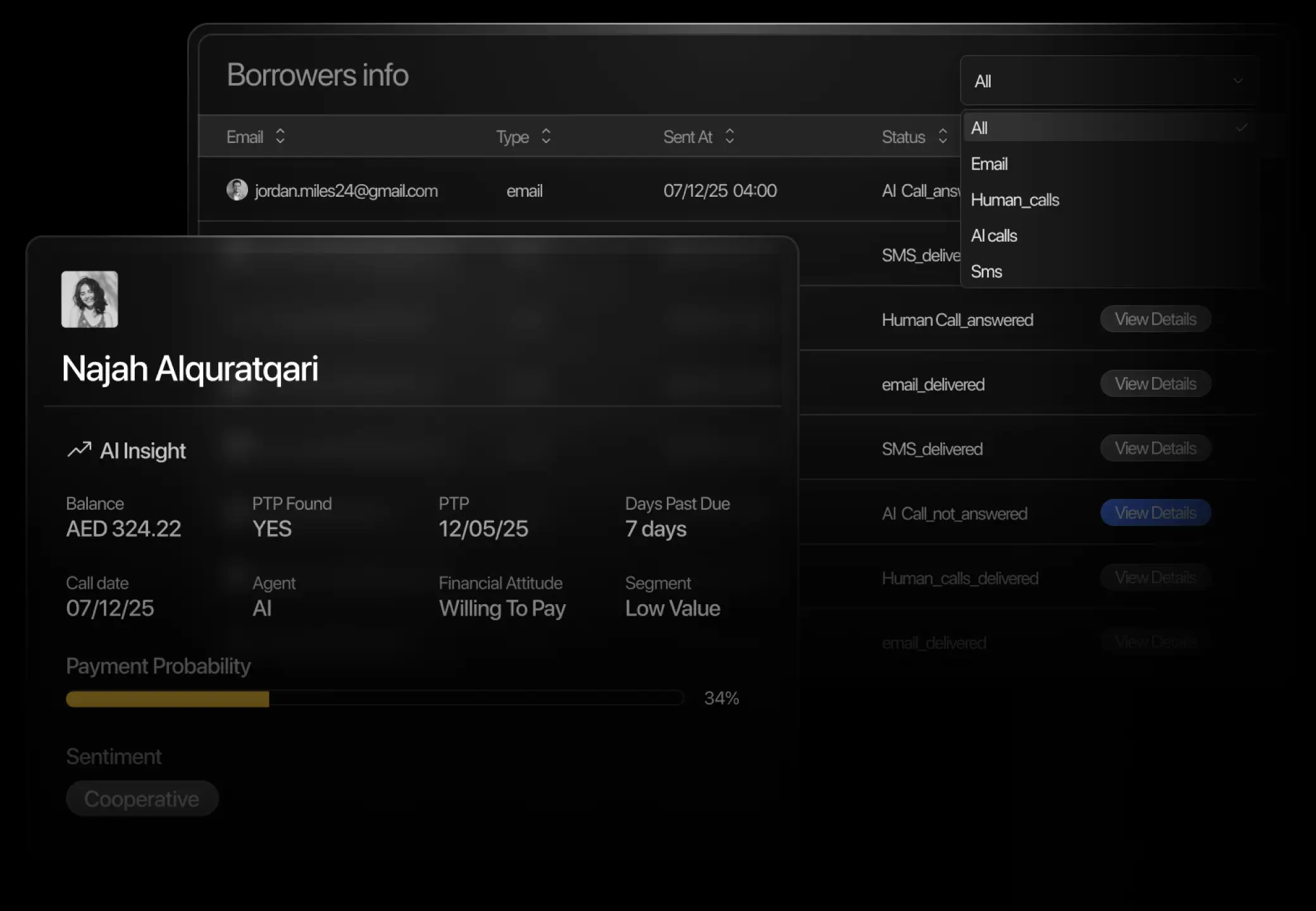

Securitization-Grade Infrastructure & Back-Up Servicing

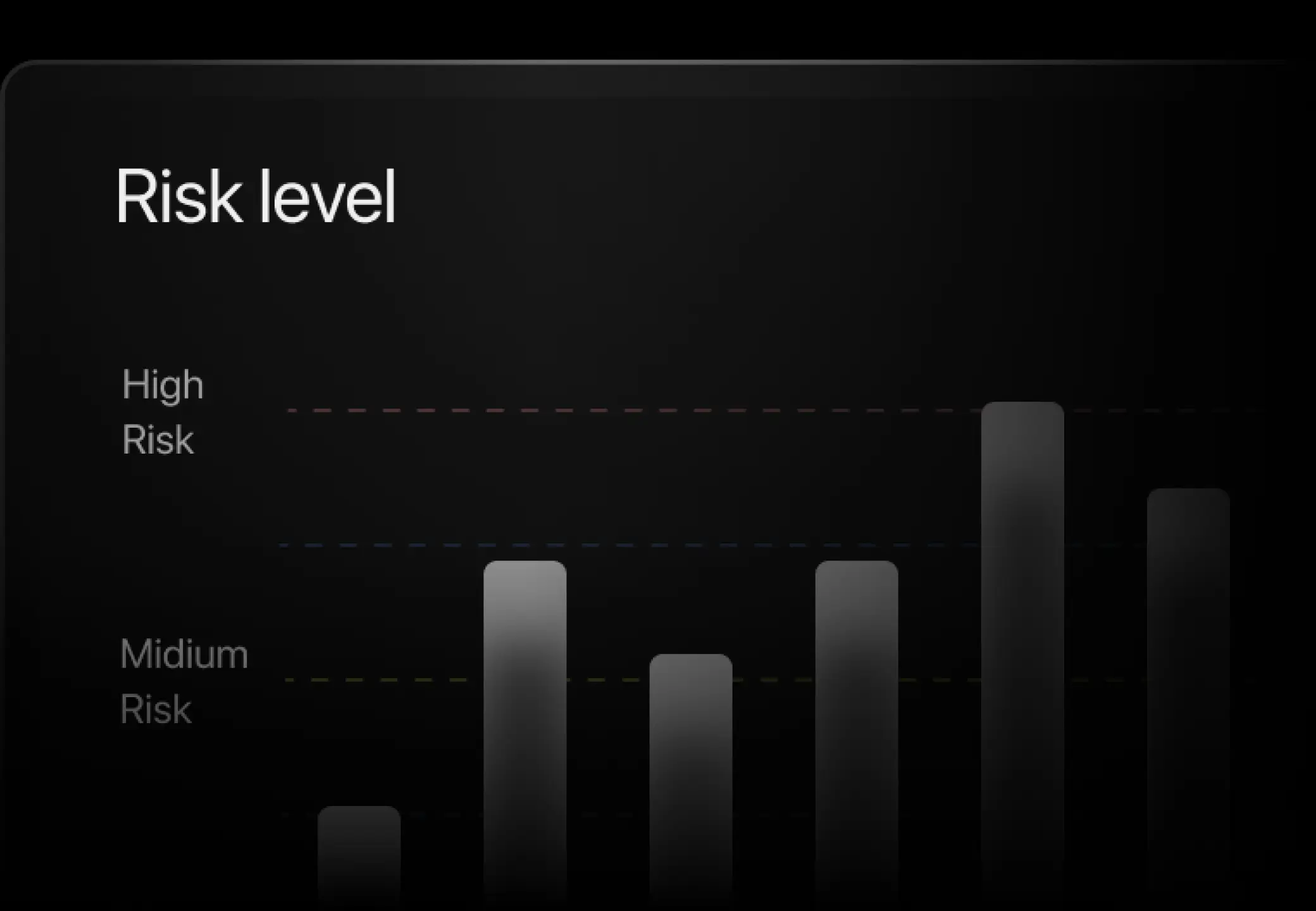

Securitize provides lenders, SPVs, and credit investors with secure infrastructure for back-up servicing, structured credit operations, and NPL risk management ensuring continuity, transparency, and investor-ready reporting.

Built for long-term servicing and complex portfolios, Securitize delivers resilient data pipelines, governance controls, and compliance-aligned workflows across the full credit lifecycle.