For Business

For Business

Smarter workflows. Higher recoveries. Real-time operational control.

AI-powered automation, predictive analytics, and secure UAE-hosted infrastructure—built for banks, BNPL providers, telecoms, fintech lenders, and enterprise credit teams.

ClearGrid helps organizations across the UAE modernize debt resolution operations through autonomous workflows, real-time intelligence, and regionally compliant infrastructure.

ClearGrid helps organizations across the UAE modernize debt resolution operations through autonomous workflows, real-time intelligence, and regionally compliant infrastructure.

ClearGrid helps organizations across the UAE modernize debt resolution operations through autonomous workflows, real-time intelligence, and regionally compliant infrastructure.

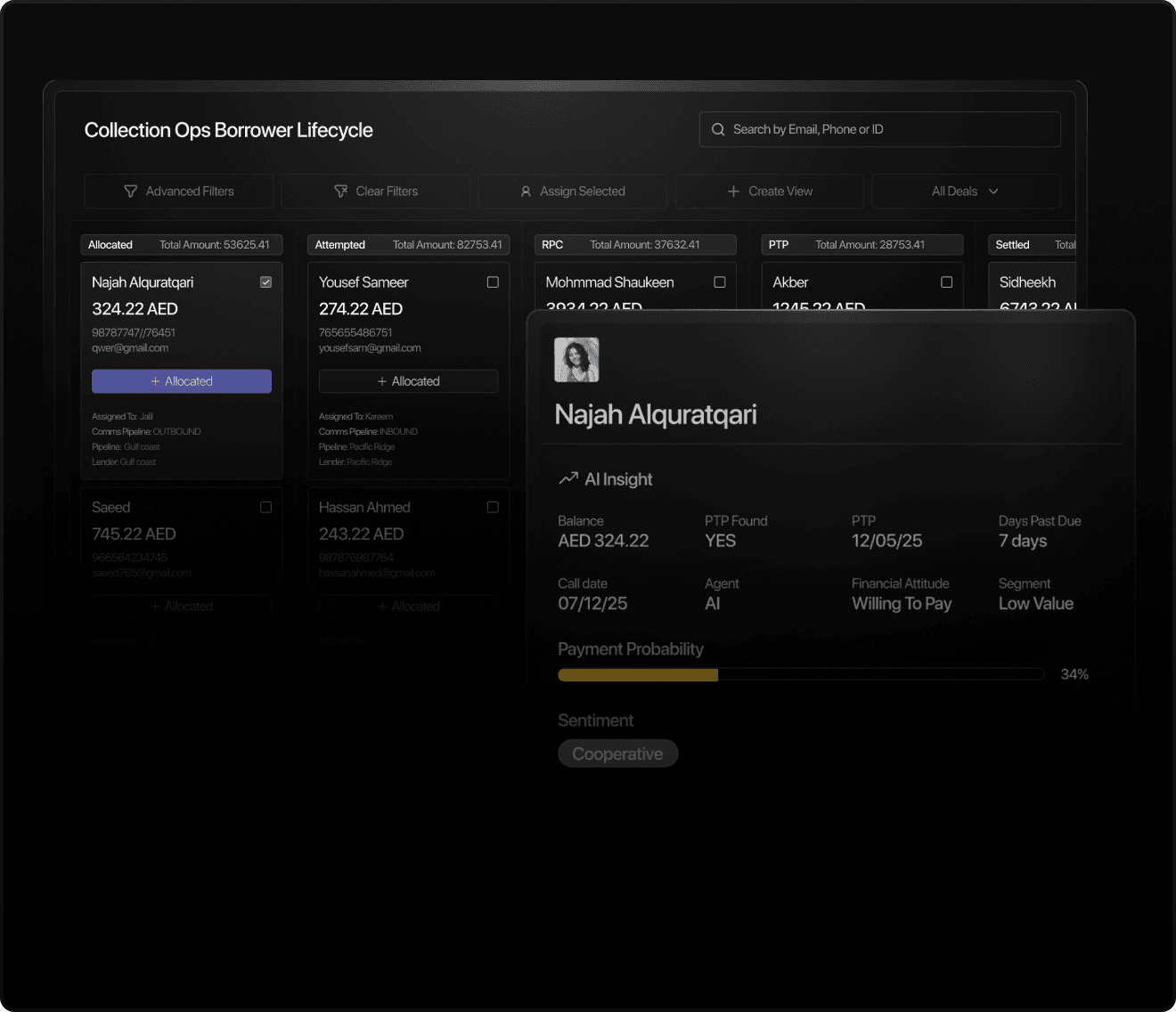

From early DPD engagement to late-stage servicing, the platform enables teams to manage portfolios more intelligently, improve right-party contact rates, and resolve cases with greater speed and precision.

From early DPD engagement to late-stage servicing, the platform enables teams to manage portfolios more intelligently, improve right-party contact rates, and resolve cases with greater speed and precision.

From early DPD engagement to late-stage servicing, the platform enables teams to manage portfolios more intelligently, improve right-party contact rates, and resolve cases with greater speed and precision.

Designed for institutions that demand accuracy, scalability, and full governance, ClearGrid delivers the future of enterprise collections powered by AI, driven by data, and built for measurable operational impact.

Designed for institutions that demand accuracy, scalability, and full governance, ClearGrid delivers the future of enterprise collections powered by AI, driven by data, and built for measurable operational impact.

Designed for institutions that demand accuracy, scalability, and full governance, ClearGrid delivers the future of enterprise collections powered by AI, driven by data, and built for measurable operational impact.

Key Benefits

Key Benefits

Key Benefits

Boost Recovery & Reduce Cost-to-Collect

AI-powered voice, messaging, and workflow automation increase engagement, improve promise-to-pay conversions, and reduce operational burden without growing headcount.

Boost Recovery & Reduce Cost-to-Collect

AI-powered voice, messaging, and workflow automation increase engagement, improve promise-to-pay conversions, and reduce operational burden without growing headcount.

Boost Recovery & Reduce Cost-to-Collect

AI-powered voice, messaging, and workflow automation increase engagement, improve promise-to-pay conversions, and reduce operational burden without growing headcount.

Scale Without Complexity

Whether managing thousands or millions of accounts, ClearGrid provides a unified system that orchestrates workflows, communication channels, and DPD stages seamlessly.

Scale Without Complexity

Whether managing thousands or millions of accounts, ClearGrid provides a unified system that orchestrates workflows, communication channels, and DPD stages seamlessly.

Scale Without Complexity

Whether managing thousands or millions of accounts, ClearGrid provides a unified system that orchestrates workflows, communication channels, and DPD stages seamlessly.

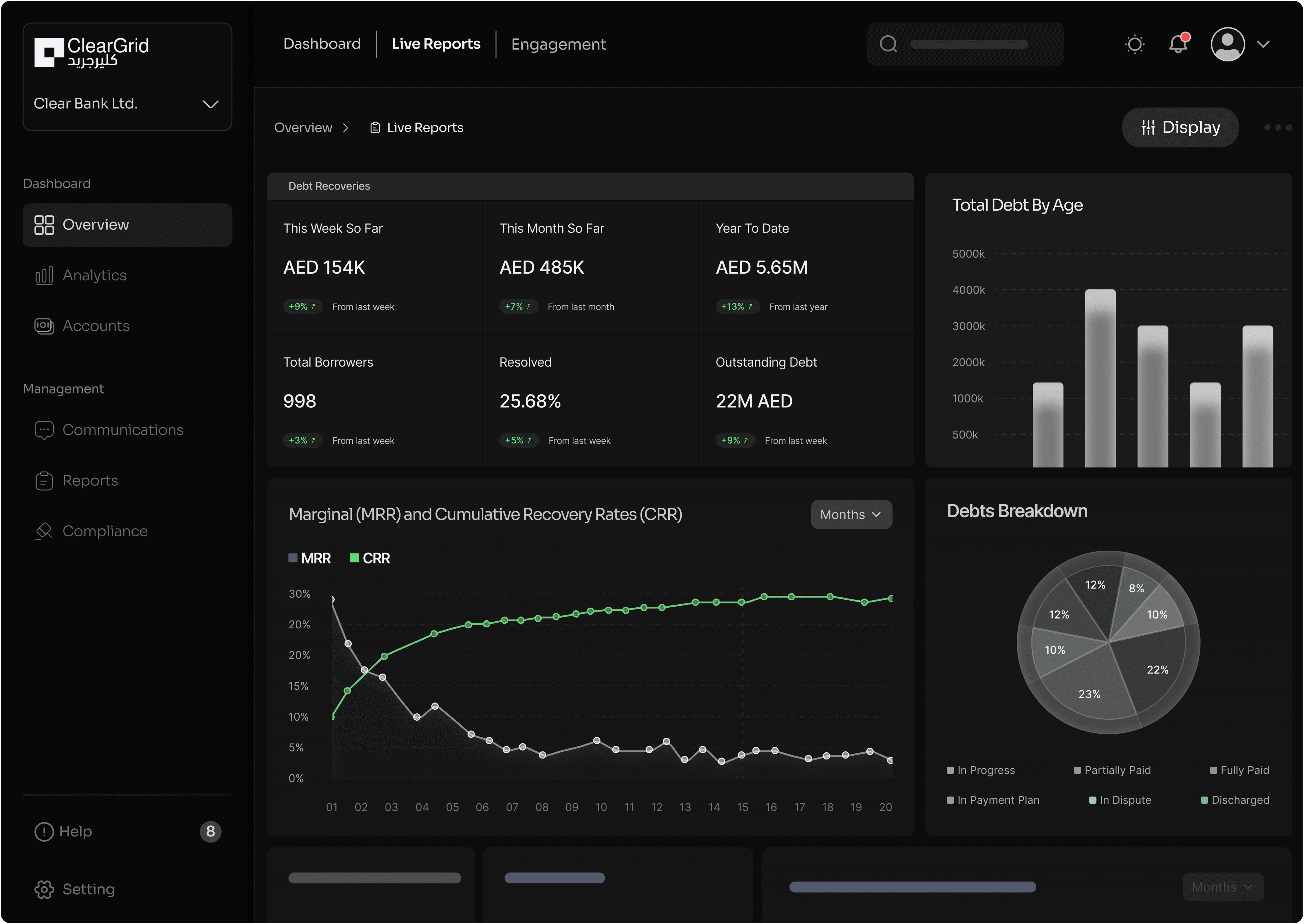

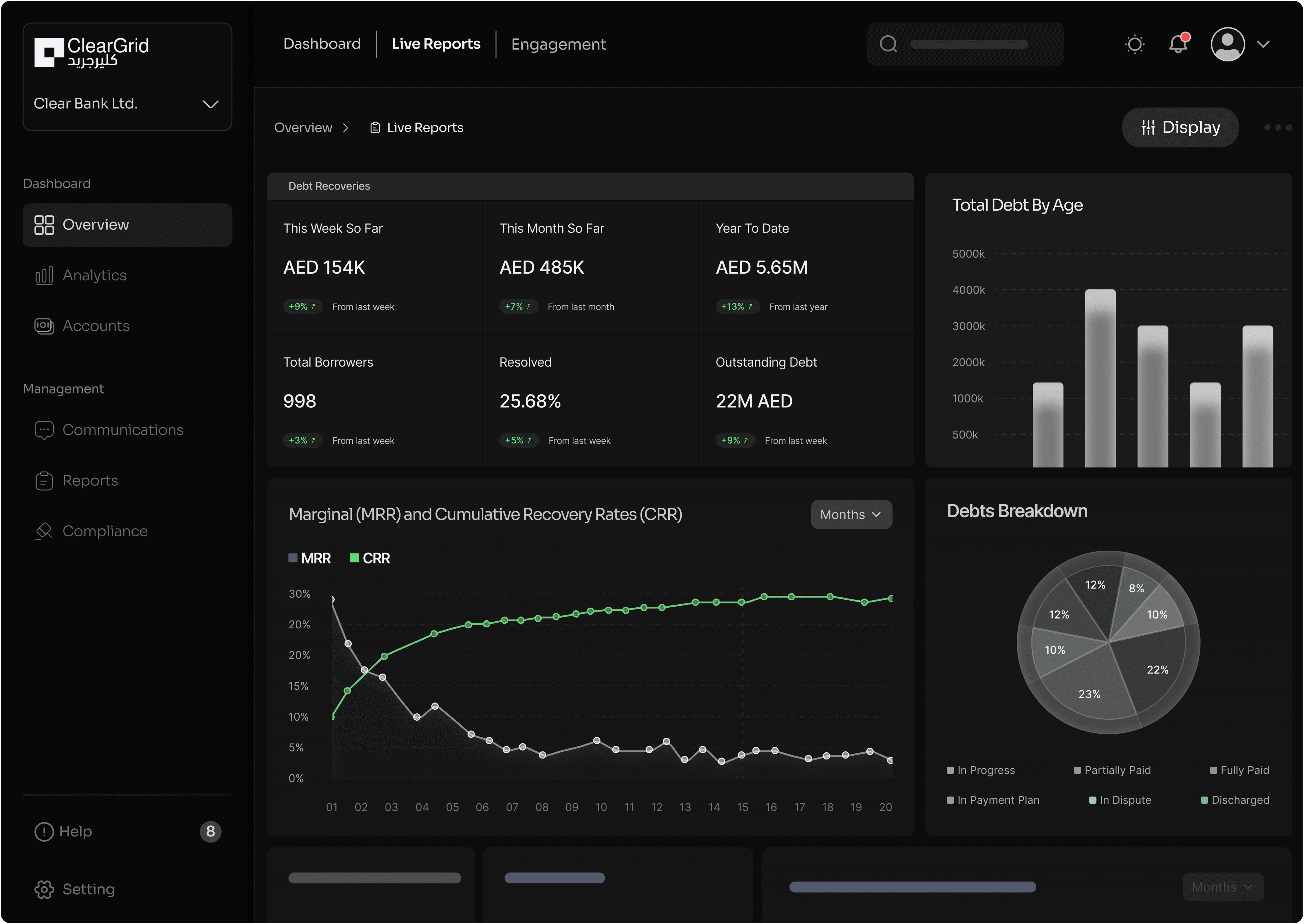

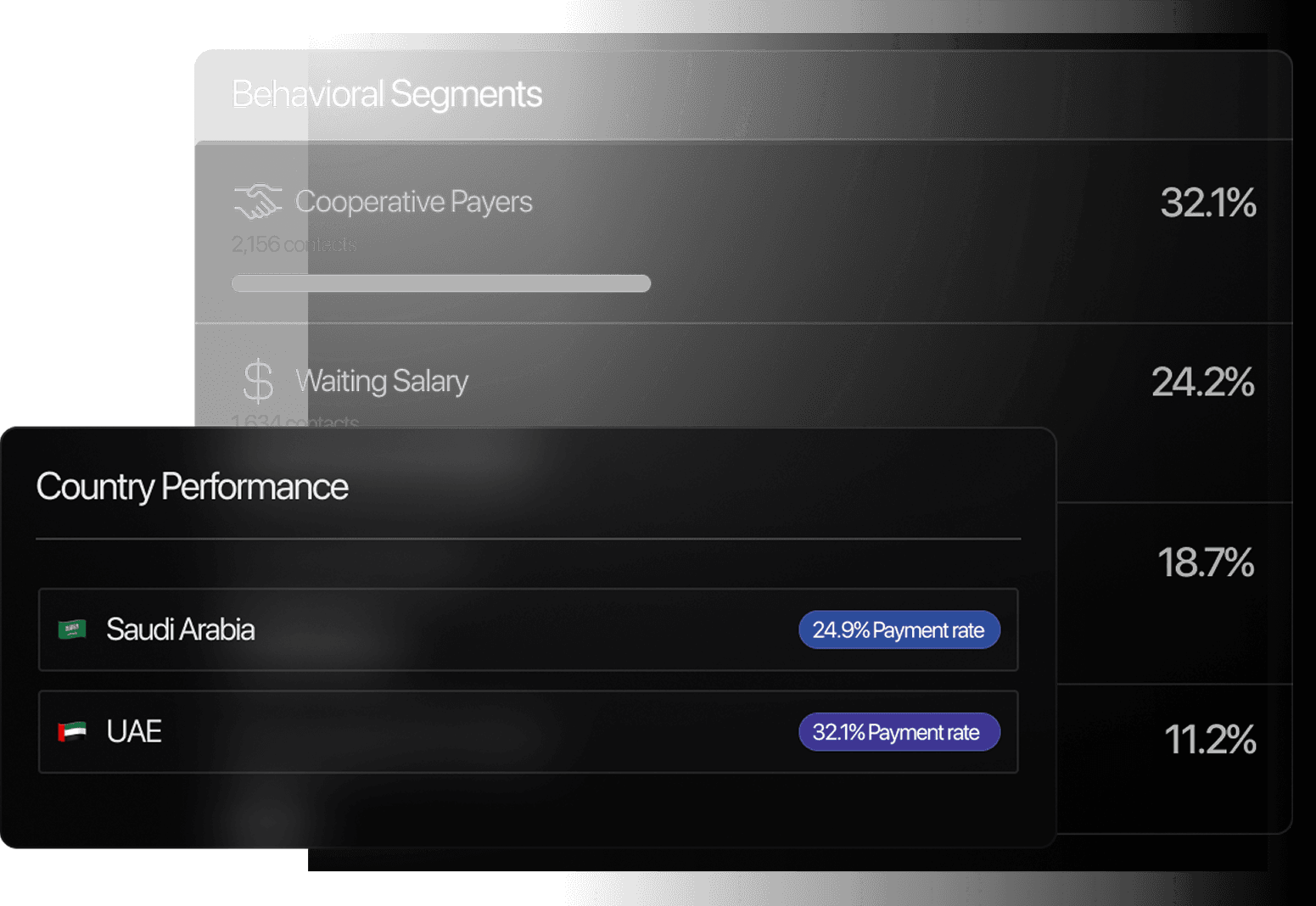

Real-Time Operational Visibility

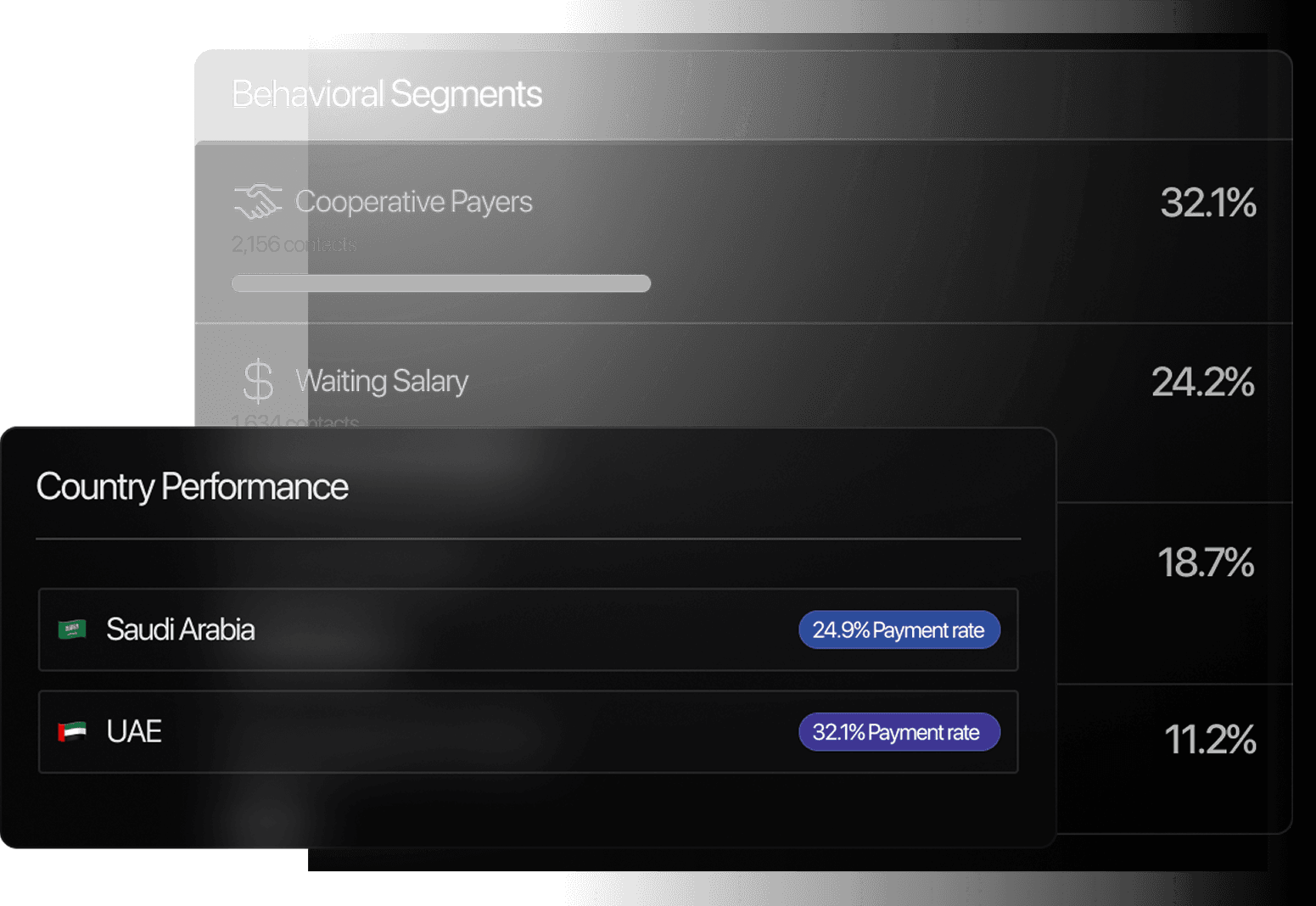

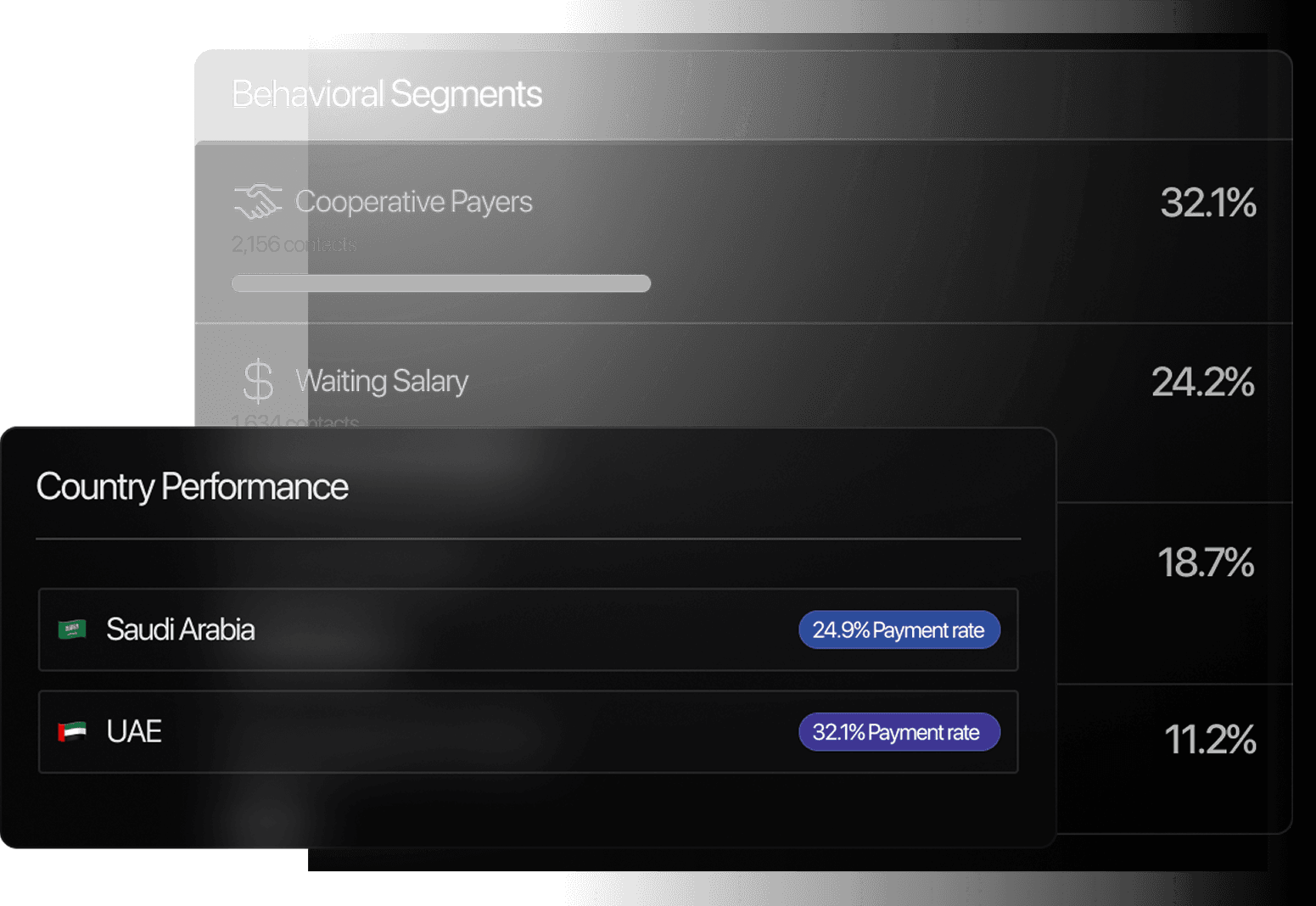

Track performance, borrower behavior, roll rates, RPC accuracy, and recovery trends through a single intelligent command center.

Real-Time Operational Visibility

Track performance, borrower behavior, roll rates, RPC accuracy, and recovery trends through a single intelligent command center.

Real-Time Operational Visibility

Track performance, borrower behavior, roll rates, RPC accuracy, and recovery trends through a single intelligent command center.

Faster, Fairer Customer Experience

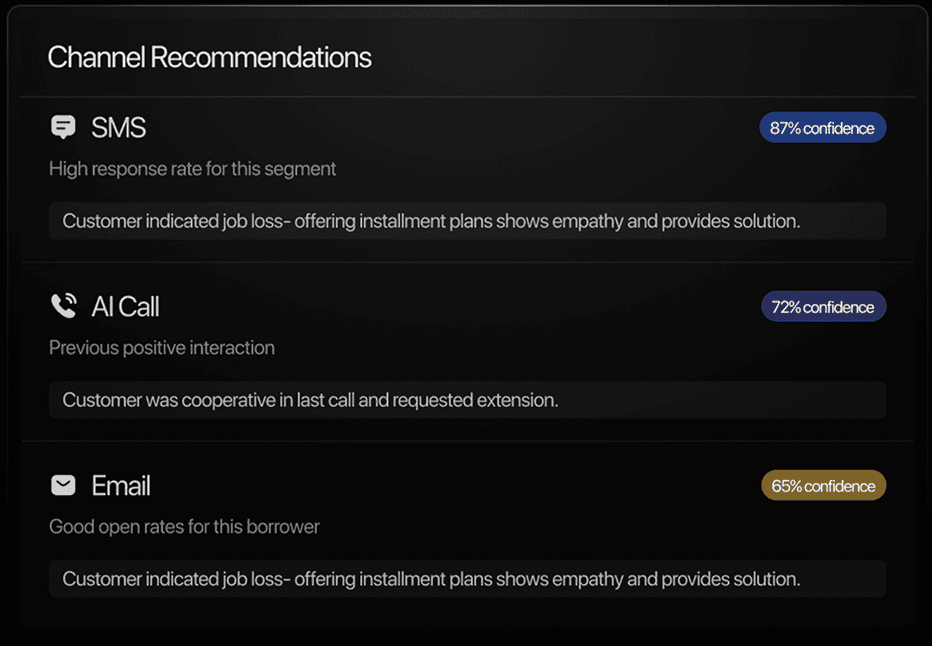

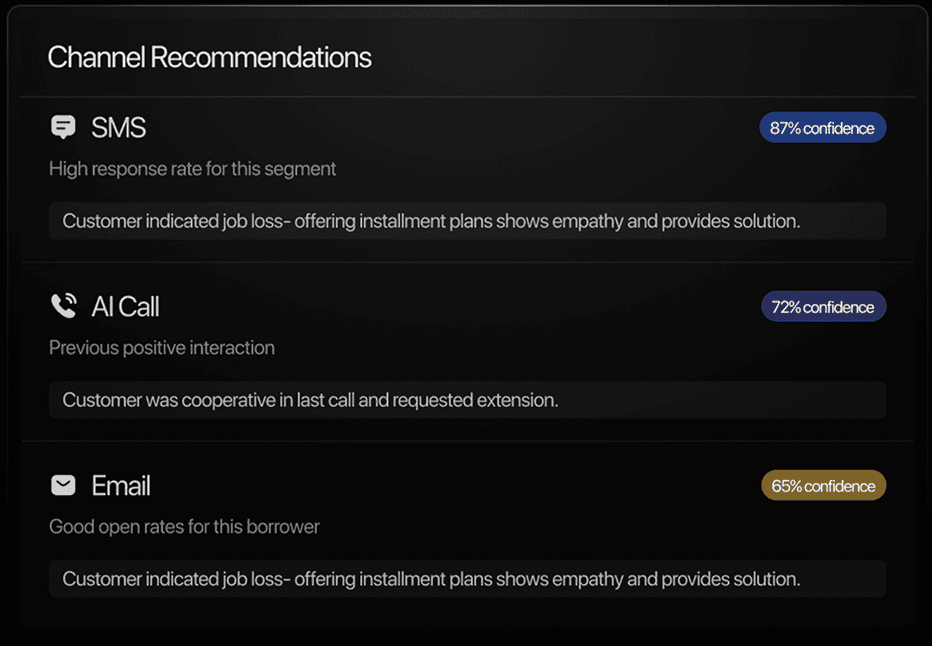

Deliver consistent, transparent communication across voice, SMS, WhatsApp, email, and in-app channels improving satisfaction while reducing complaints.

Faster, Fairer Customer Experience

Deliver consistent, transparent communication across voice, SMS, WhatsApp, email, and in-app channels improving satisfaction while reducing complaints.

Faster, Fairer Customer Experience

Deliver consistent, transparent communication across voice, SMS, WhatsApp, email, and in-app channels improving satisfaction while reducing complaints.

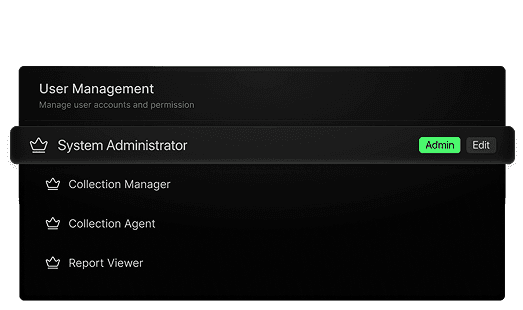

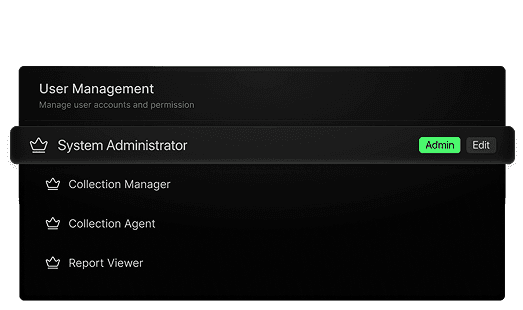

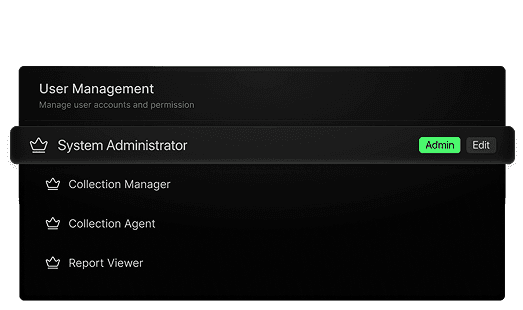

Aligned with UAE & GCC Compliance

Role-based access, structured audit trails, in-country data residency, governance tooling, and regulatory-ready infrastructure for the UAE.

Aligned with UAE & GCC Compliance

Role-based access, structured audit trails, in-country data residency, governance tooling, and regulatory-ready infrastructure for the UAE.

Aligned with UAE & GCC Compliance

Role-based access, structured audit trails, in-country data residency, governance tooling, and regulatory-ready infrastructure for the UAE.

Our Products

Our Products

Our Products

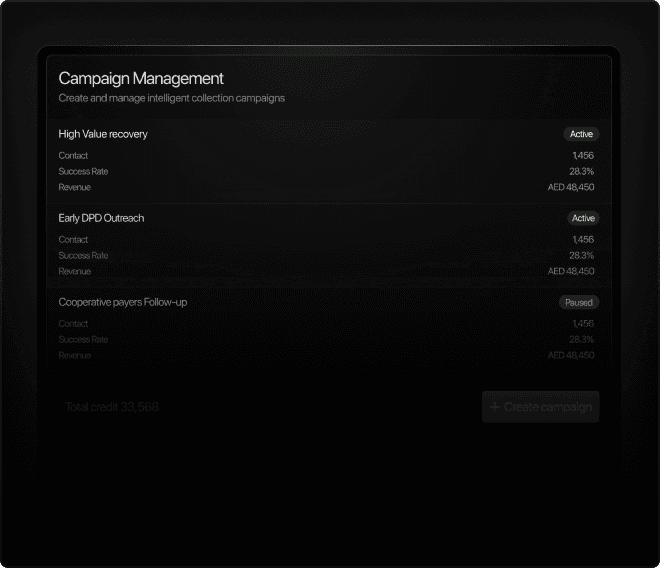

Smarter workflows. Higher recoveries. Real-time operational control.

Industries

We Serve

Banks & Financial Institutions

BNPL Providers

Telecom Credit Departments

Car Rental & Mobility Groups

Digital Lenders & Fintechs

SMEs Managing High-Volume Credit

Third-Party Collection Agencies

FAQ’s

What does ClearGrid do?

ClearGrid is an AI-powered debt resolution platform that automates engagement, segmentation, workflows, and servicing helping organizations improve recovery, reduce cost, and gain full operational visibility.

What does ClearGrid do?

ClearGrid is an AI-powered debt resolution platform that automates engagement, segmentation, workflows, and servicing helping organizations improve recovery, reduce cost, and gain full operational visibility.

What does ClearGrid do?

ClearGrid is an AI-powered debt resolution platform that automates engagement, segmentation, workflows, and servicing helping organizations improve recovery, reduce cost, and gain full operational visibility.

How does ClearGrid integrate with existing systems?

ClearGrid integrates via secure APIs, SFTP pipelines, or custom connectors. It supports real-time ingestion, batch processing, and automated reconciliation with core banking systems, CRMs, LMS platforms, and agency tools.

How does ClearGrid integrate with existing systems?

ClearGrid integrates via secure APIs, SFTP pipelines, or custom connectors. It supports real-time ingestion, batch processing, and automated reconciliation with core banking systems, CRMs, LMS platforms, and agency tools.

How does ClearGrid integrate with existing systems?

ClearGrid integrates via secure APIs, SFTP pipelines, or custom connectors. It supports real-time ingestion, batch processing, and automated reconciliation with core banking systems, CRMs, LMS platforms, and agency tools.

Is ClearGrid compliant with UAE and GCC regulations?

Yes. ClearGrid operates on UAE- and KSA-hosted cloud infrastructure, with data residency, encryption, audit trails, role-based access, and governance tooling aligned with Central Bank guidelines and regional best practices.

Is ClearGrid compliant with UAE and GCC regulations?

Yes. ClearGrid operates on UAE- and KSA-hosted cloud infrastructure, with data residency, encryption, audit trails, role-based access, and governance tooling aligned with Central Bank guidelines and regional best practices.

Is ClearGrid compliant with UAE and GCC regulations?

Yes. ClearGrid operates on UAE- and KSA-hosted cloud infrastructure, with data residency, encryption, audit trails, role-based access, and governance tooling aligned with Central Bank guidelines and regional best practices.

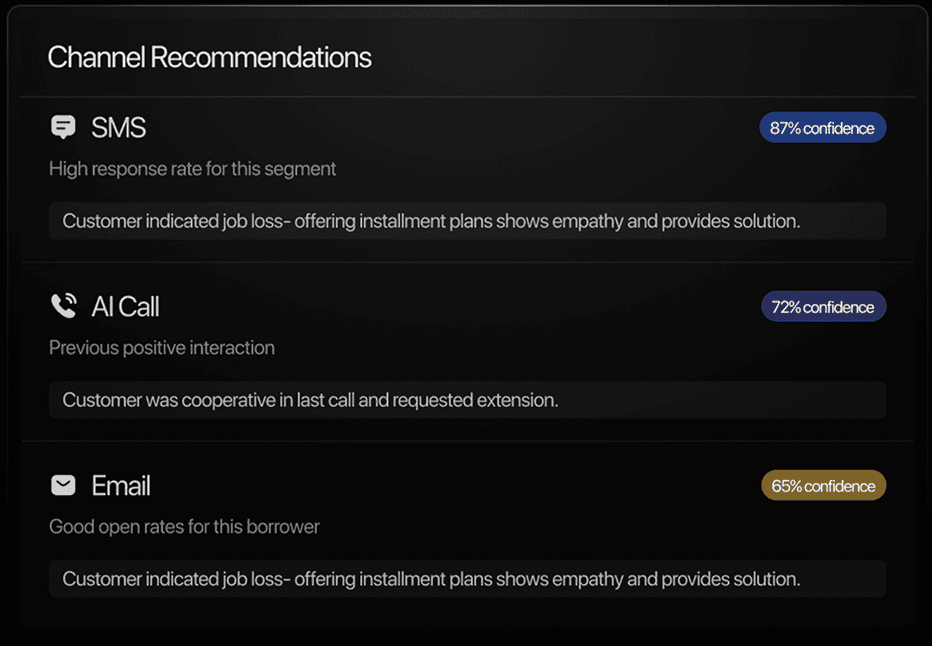

How does ClearGrid use AI in collections?

AI powers borrower segmentation, risk scoring, contact strategies, voice engagement, behavioral prediction, and workflow decisioning optimizing the best action, channel, timing, and message for each case.

How does ClearGrid use AI in collections?

AI powers borrower segmentation, risk scoring, contact strategies, voice engagement, behavioral prediction, and workflow decisioning optimizing the best action, channel, timing, and message for each case.

How does ClearGrid use AI in collections?

AI powers borrower segmentation, risk scoring, contact strategies, voice engagement, behavioral prediction, and workflow decisioning optimizing the best action, channel, timing, and message for each case.

Can ClearGrid support large, high-volume portfolios?

Yes. The platform is built for enterprise scale and supports portfolios ranging from thousands to millions of accounts with automated processing and monitoring.

Can ClearGrid support large, high-volume portfolios?

Yes. The platform is built for enterprise scale and supports portfolios ranging from thousands to millions of accounts with automated processing and monitoring.

Can ClearGrid support large, high-volume portfolios?

Yes. The platform is built for enterprise scale and supports portfolios ranging from thousands to millions of accounts with automated processing and monitoring.

What products are included in ClearGrid?

- ClearCommand for early-stage collections and AI-driven engagement - ClearAllocate for agency management and performance oversight - ClearSecuritize for late-stage servicing and structured credit Each product can operate independently or as part of one unified ecosystem.

What products are included in ClearGrid?

- ClearCommand for early-stage collections and AI-driven engagement - ClearAllocate for agency management and performance oversight - ClearSecuritize for late-stage servicing and structured credit Each product can operate independently or as part of one unified ecosystem.

What products are included in ClearGrid?

- ClearCommand for early-stage collections and AI-driven engagement - ClearAllocate for agency management and performance oversight - ClearSecuritize for late-stage servicing and structured credit Each product can operate independently or as part of one unified ecosystem.

How secure is borrower data?

All data is encrypted in transit and at rest, hosted in UAE data centers, and protected by multi-layered access controls, audit logs, and enterprise-grade security measures.

How secure is borrower data?

All data is encrypted in transit and at rest, hosted in UAE data centers, and protected by multi-layered access controls, audit logs, and enterprise-grade security measures.

How secure is borrower data?

All data is encrypted in transit and at rest, hosted in UAE data centers, and protected by multi-layered access controls, audit logs, and enterprise-grade security measures.

Can internal teams continue collecting while using ClearGrid?

Yes. ClearGrid enhances existing operations supporting internal teams, autonomous engagement, or selective agency routing based on your strategy.

Can internal teams continue collecting while using ClearGrid?

Yes. ClearGrid enhances existing operations supporting internal teams, autonomous engagement, or selective agency routing based on your strategy.

Can internal teams continue collecting while using ClearGrid?

Yes. ClearGrid enhances existing operations supporting internal teams, autonomous engagement, or selective agency routing based on your strategy.

Can ClearGrid be used without third-party agencies?

Absolutely. Command fully supports in-house collections. Allocate is optional and used only if agency management is required.

Can ClearGrid be used without third-party agencies?

Absolutely. Command fully supports in-house collections. Allocate is optional and used only if agency management is required.

Can ClearGrid be used without third-party agencies?

Absolutely. Command fully supports in-house collections. Allocate is optional and used only if agency management is required.

How quickly can ClearGrid be implemented?

Typical onboarding takes 2–6 weeks, depending on data readiness, compliance validation, and workflow complexity. Full onboarding support is included.

How quickly can ClearGrid be implemented?

Typical onboarding takes 2–6 weeks, depending on data readiness, compliance validation, and workflow complexity. Full onboarding support is included.

How quickly can ClearGrid be implemented?

Typical onboarding takes 2–6 weeks, depending on data readiness, compliance validation, and workflow complexity. Full onboarding support is included.

What differentiates ClearGrid from traditional collection systems?

- AI-first automation - Real-time dashboards - Omni-channel engagement - Unified borrower trails - Predictive modeling - GCC-native compliance - End-to-end workflow orchestration ClearGrid replaces manual processes with intelligent systems that deliver consistent, scalable results.

What differentiates ClearGrid from traditional collection systems?

- AI-first automation - Real-time dashboards - Omni-channel engagement - Unified borrower trails - Predictive modeling - GCC-native compliance - End-to-end workflow orchestration ClearGrid replaces manual processes with intelligent systems that deliver consistent, scalable results.

What differentiates ClearGrid from traditional collection systems?

- AI-first automation - Real-time dashboards - Omni-channel engagement - Unified borrower trails - Predictive modeling - GCC-native compliance - End-to-end workflow orchestration ClearGrid replaces manual processes with intelligent systems that deliver consistent, scalable results.

How does pricing work?

Pricing is flexible and based on portfolio size, usage, and selected modules. Organizations may license individual products or the full ClearGrid suite, with subscription and optional performance-based models.

How does pricing work?

Pricing is flexible and based on portfolio size, usage, and selected modules. Organizations may license individual products or the full ClearGrid suite, with subscription and optional performance-based models.

How does pricing work?

Pricing is flexible and based on portfolio size, usage, and selected modules. Organizations may license individual products or the full ClearGrid suite, with subscription and optional performance-based models.

Does ClearGrid support voice calls?

Yes. ClearGrid includes an AI Voice Engine that delivers automated, compliant, high-quality calls fully integrated with workflows to improve RPC and accelerate resolution.

Does ClearGrid support voice calls?

Yes. ClearGrid includes an AI Voice Engine that delivers automated, compliant, high-quality calls fully integrated with workflows to improve RPC and accelerate resolution.

Does ClearGrid support voice calls?

Yes. ClearGrid includes an AI Voice Engine that delivers automated, compliant, high-quality calls fully integrated with workflows to improve RPC and accelerate resolution.

Can workflows and rules be customized?

Yes. Command includes a configurable rules engine allowing full control over actions, triggers, segments, and escalation paths.

Can workflows and rules be customized?

Yes. Command includes a configurable rules engine allowing full control over actions, triggers, segments, and escalation paths.

Can workflows and rules be customized?

Yes. Command includes a configurable rules engine allowing full control over actions, triggers, segments, and escalation paths.

Which industries does ClearGrid support?

Banks, BNPL providers, telecoms, fintech lenders, car rental groups, SMEs, and third-party collection agencies across the UAE and wider GCC.

Which industries does ClearGrid support?

Banks, BNPL providers, telecoms, fintech lenders, car rental groups, SMEs, and third-party collection agencies across the UAE and wider GCC.

Which industries does ClearGrid support?

Banks, BNPL providers, telecoms, fintech lenders, car rental groups, SMEs, and third-party collection agencies across the UAE and wider GCC.

Ready to modernize your collections?

Ready to modernize your collections?

Build a faster, smarter, and more controlled resolution process today.

Build a faster, smarter, and more controlled resolution process today.