Modern Debt Resolution That Scales With Your Business

Modern Debt Resolution That Scales With Your Business

From early-stage engagement to structured servicing, ClearGrid delivers AI-driven workflows, omni-channel communication, and full operational visibility, all from one secure platform.

From early-stage engagement to structured servicing, ClearGrid delivers AI-driven workflows, omni-channel communication, and full operational visibility, all from one secure platform.

ClearGrid is a next-generation debt resolution partner helping institutions improve recovery, reduce cost-to-collect, and enhance customer experience across the full DPD spectrum.

ClearGrid is a next-generation debt resolution partner helping institutions improve recovery, reduce cost-to-collect, and enhance customer experience across the full DPD spectrum.

ClearGrid is a next-generation debt resolution partner helping institutions improve recovery, reduce cost-to-collect, and enhance customer experience across the full DPD spectrum.

Using predictive AI, omni-channel orchestration, and real-time portfolio intelligence, we create a resolution process that is faster, fairer, and more consistent, for lenders and borrowers alike.

Using predictive AI, omni-channel orchestration, and real-time portfolio intelligence, we create a resolution process that is faster, fairer, and more consistent, for lenders and borrowers alike.

Using predictive AI, omni-channel orchestration, and real-time portfolio intelligence, we create a resolution process that is faster, fairer, and more consistent, for lenders and borrowers alike.

Key Benefits

Key Benefits

Key Benefits

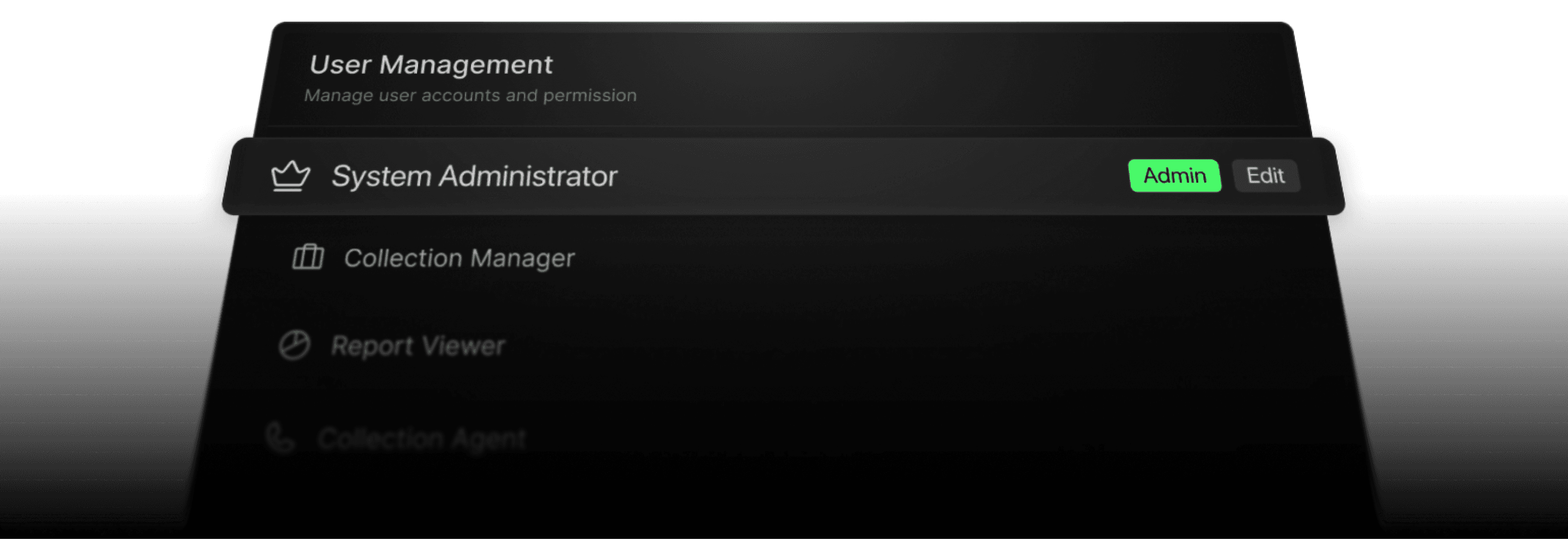

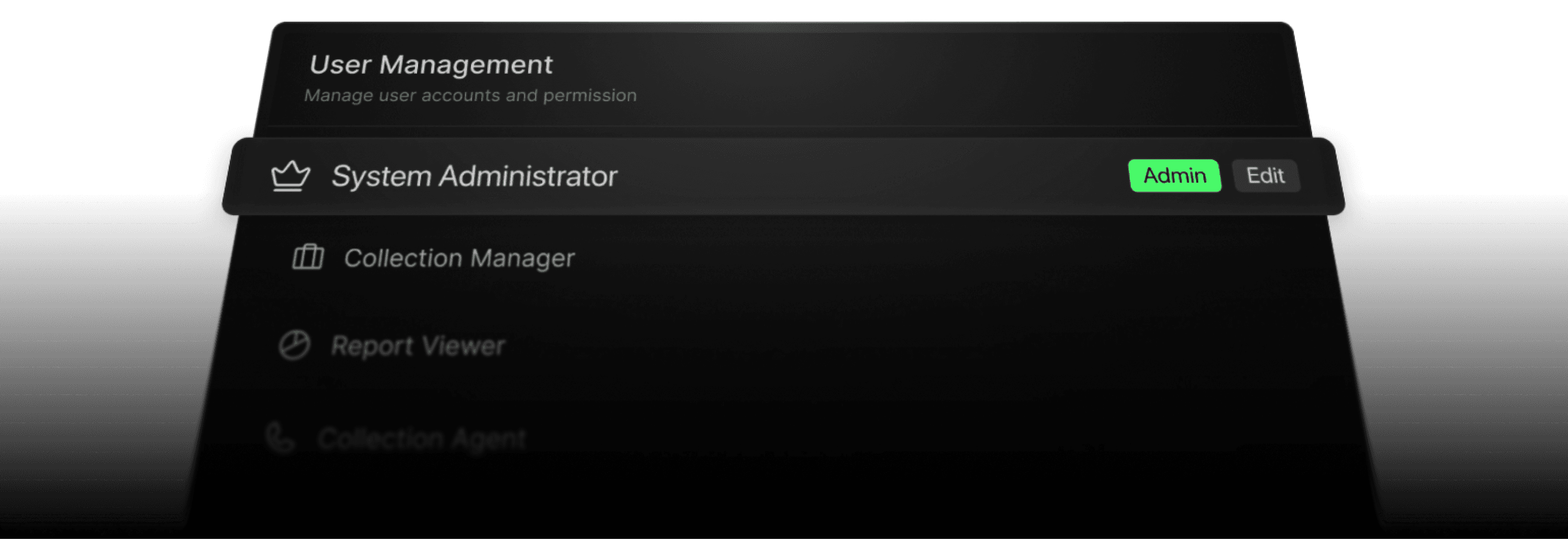

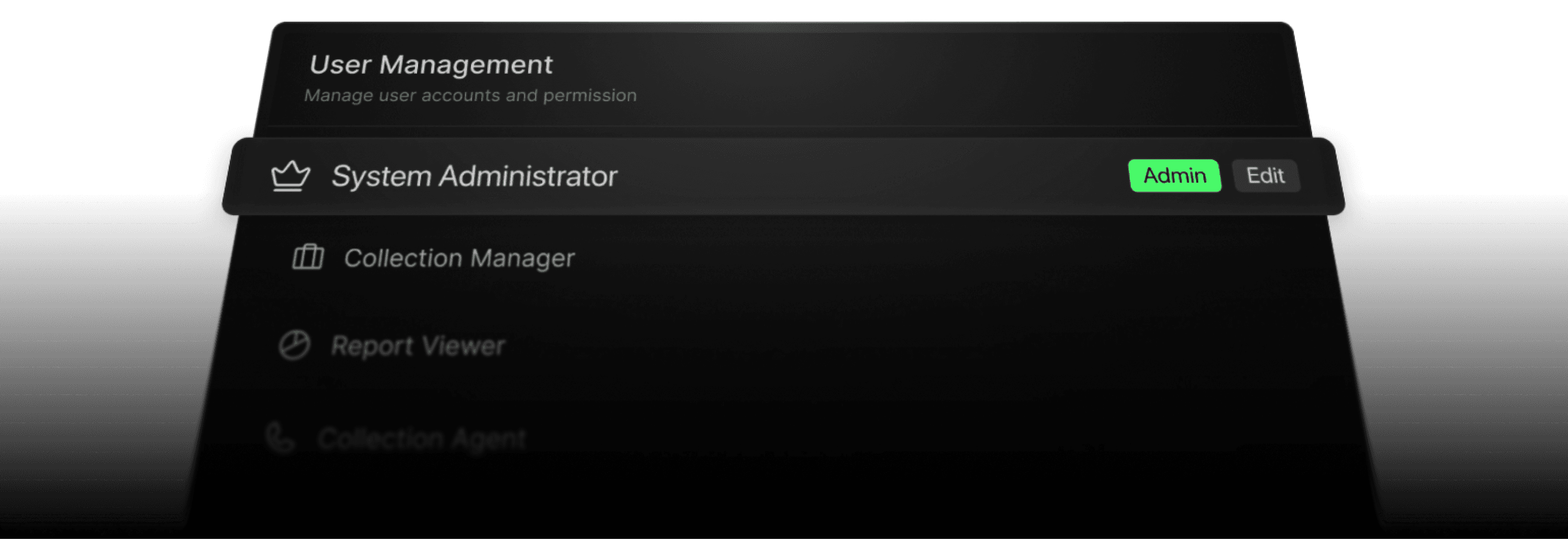

Secure Admin Panel

Governance tools, approvals, roles, and audit controls.

Secure Admin Panel

Governance tools, approvals, roles, and audit controls.

Secure Admin Panel

Governance tools, approvals, roles, and audit controls.

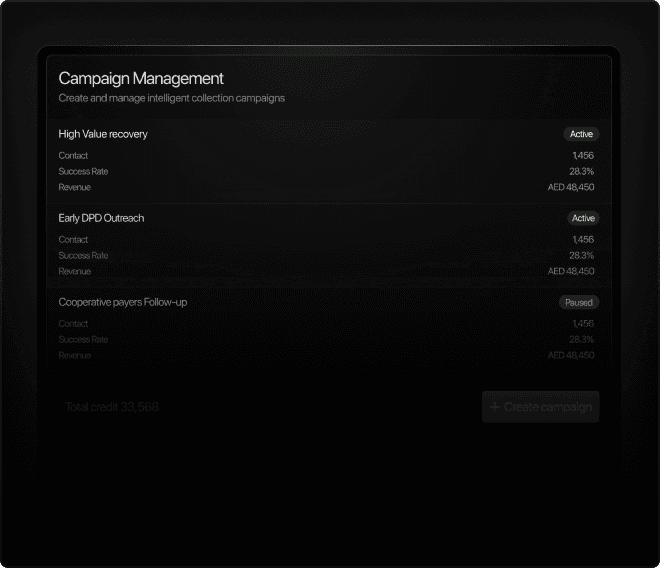

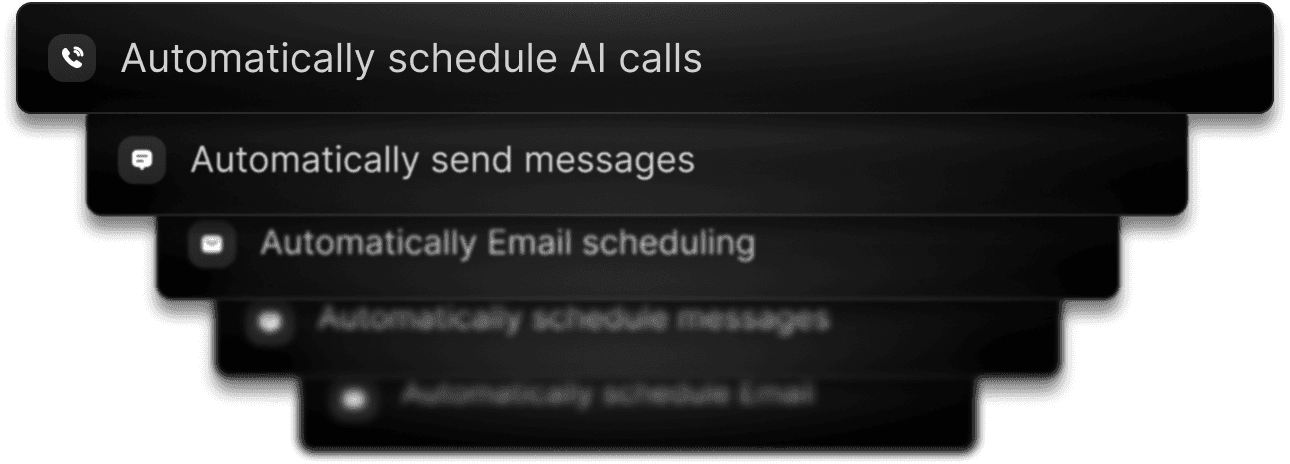

Workflow Automation

Behavior-based orchestration for every borrower segment.

Workflow Automation

Behavior-based orchestration for every borrower segment.

Workflow Automation

Behavior-based orchestration for every borrower segment.

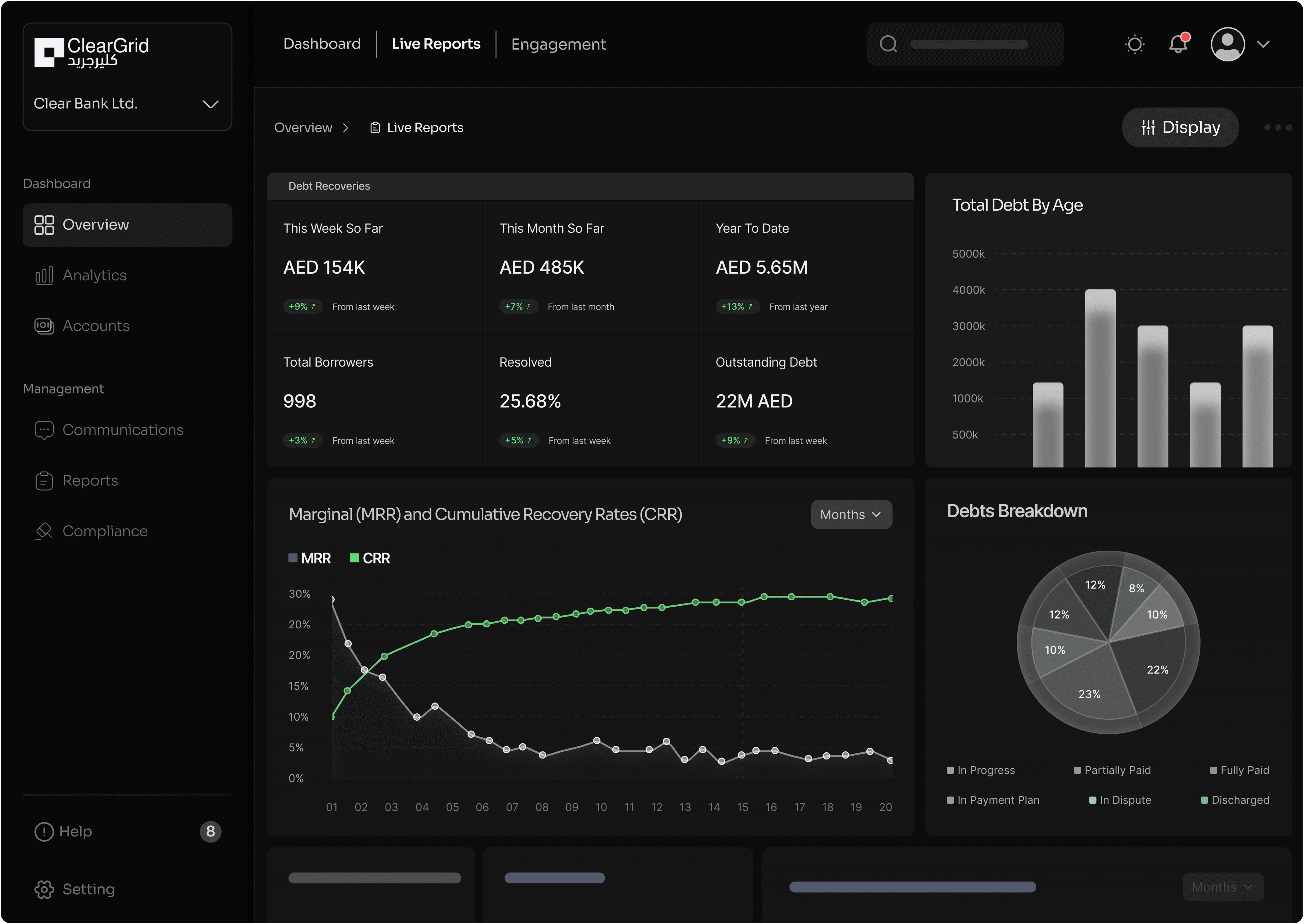

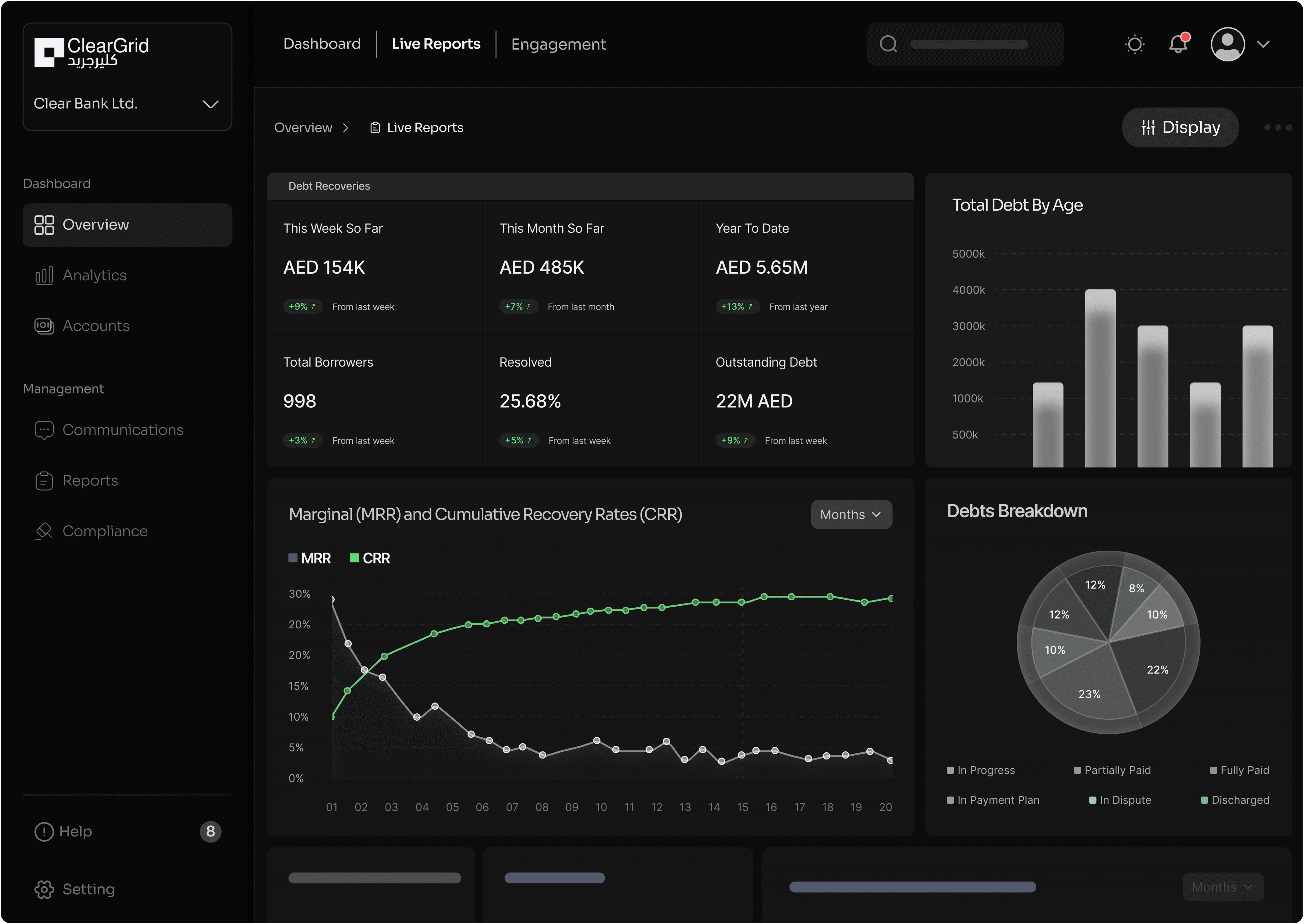

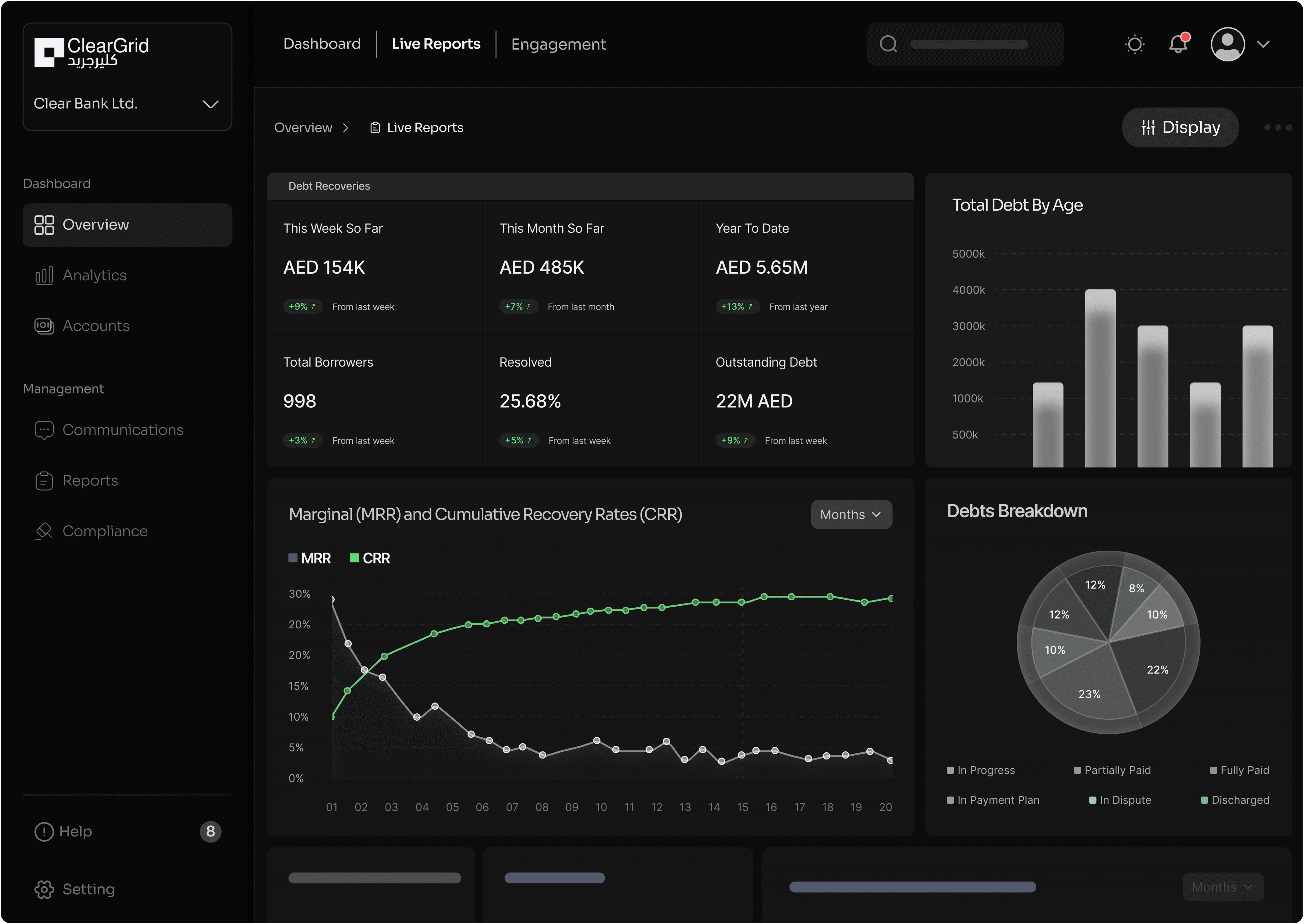

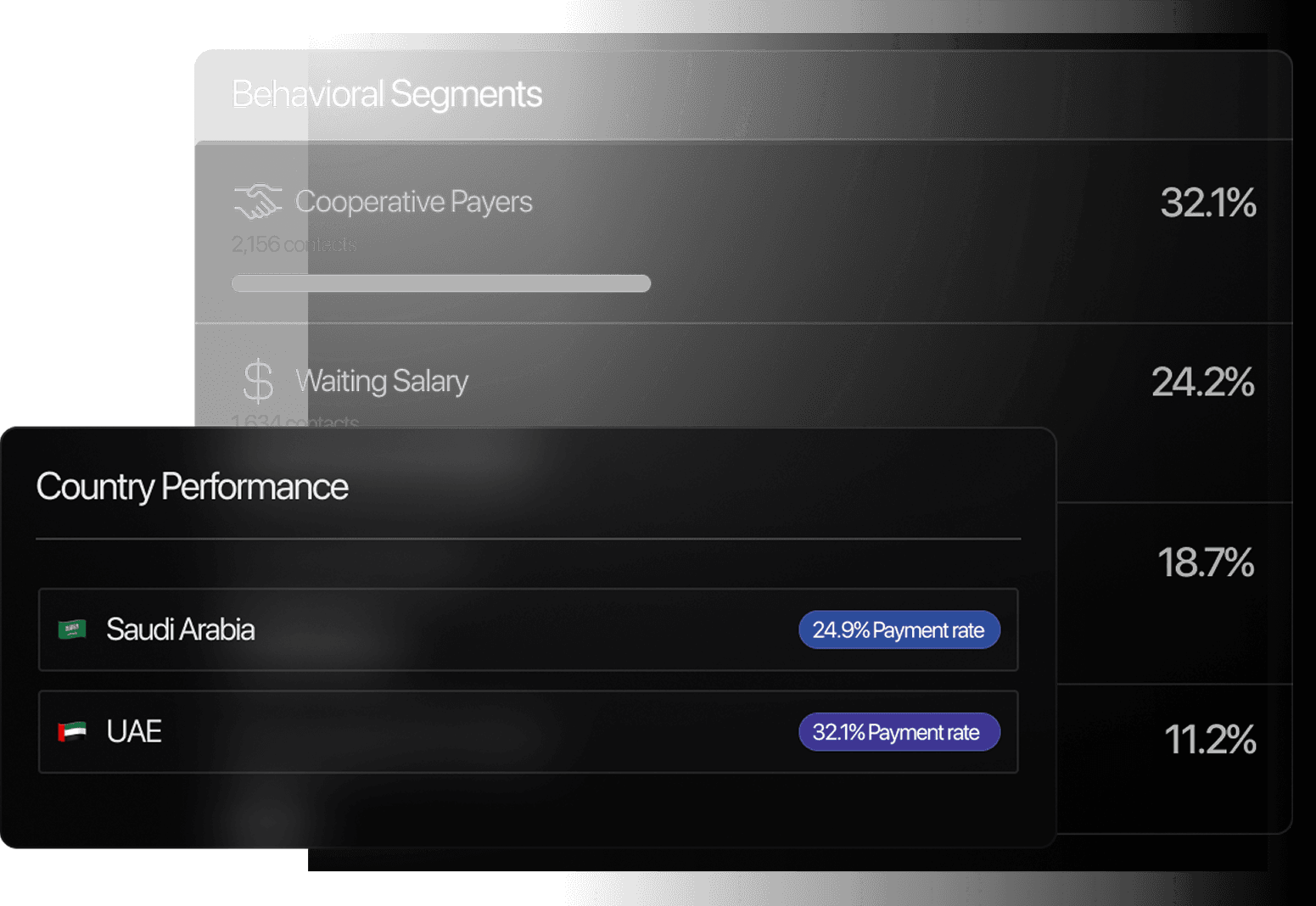

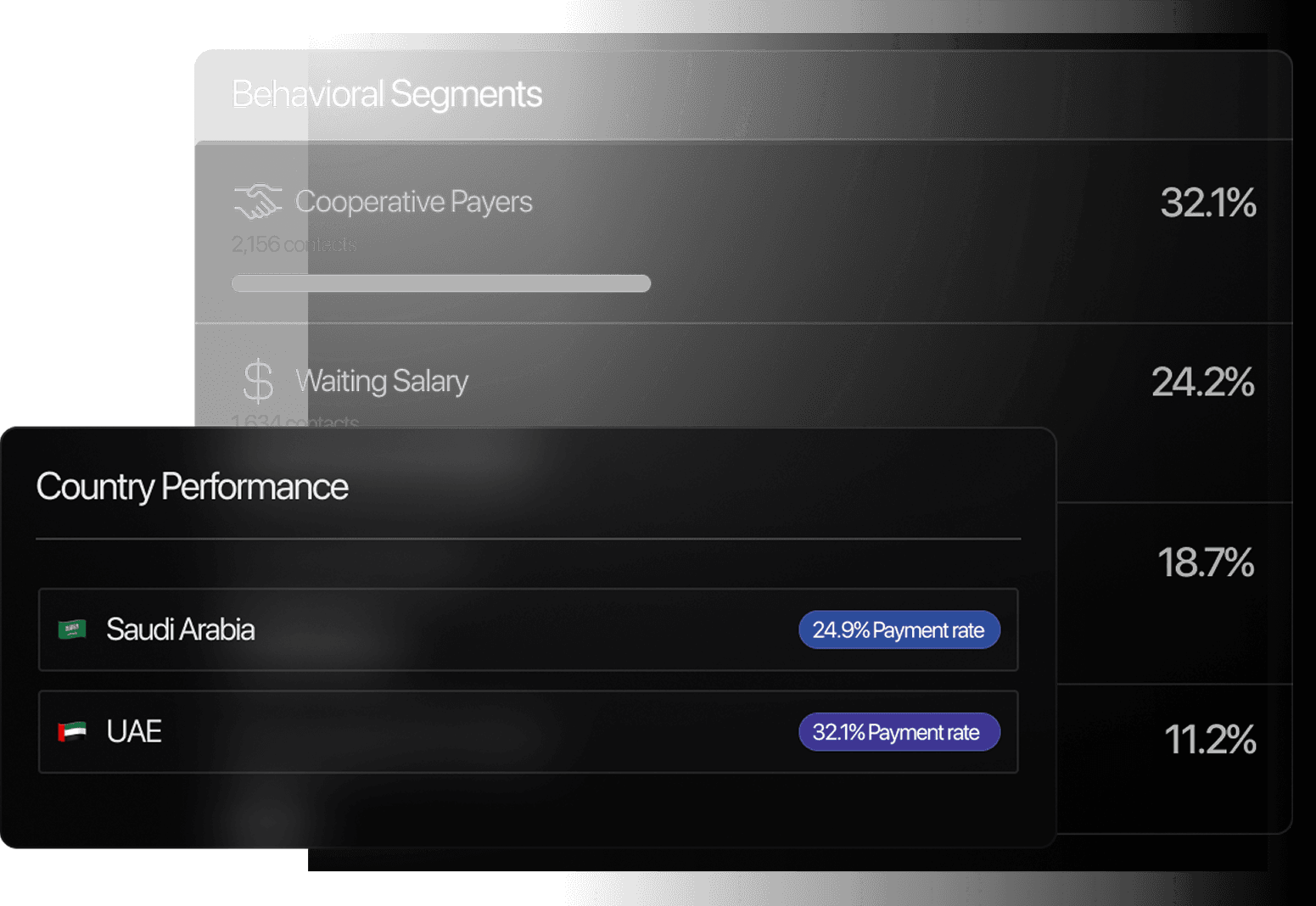

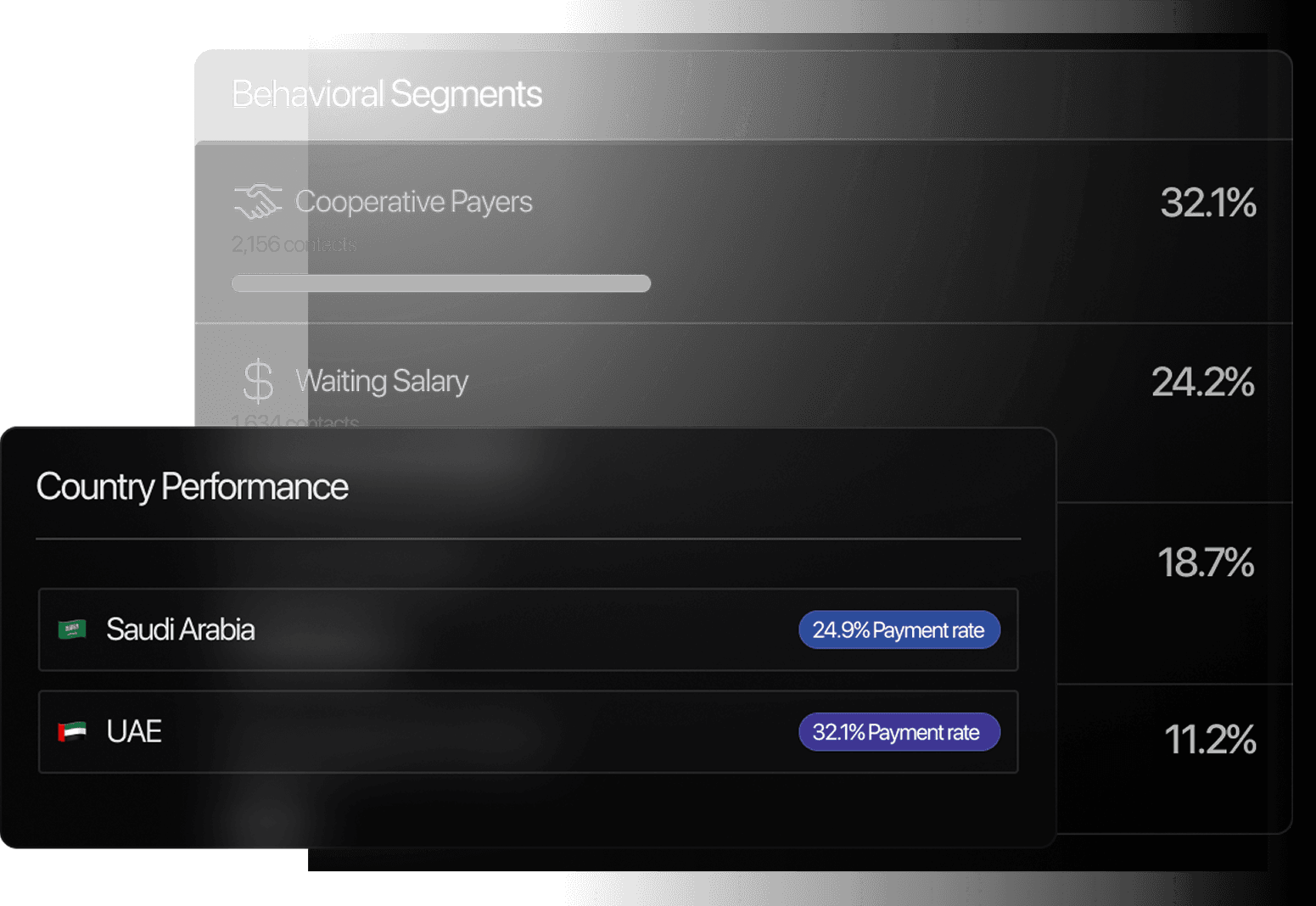

Real-Time Operational Visibility

Portfolio insights, DPD movement, and trend intelligence.

Real-Time Operational Visibility

Portfolio insights, DPD movement, and trend intelligence.

Real-Time Operational Visibility

Portfolio insights, DPD movement, and trend intelligence.

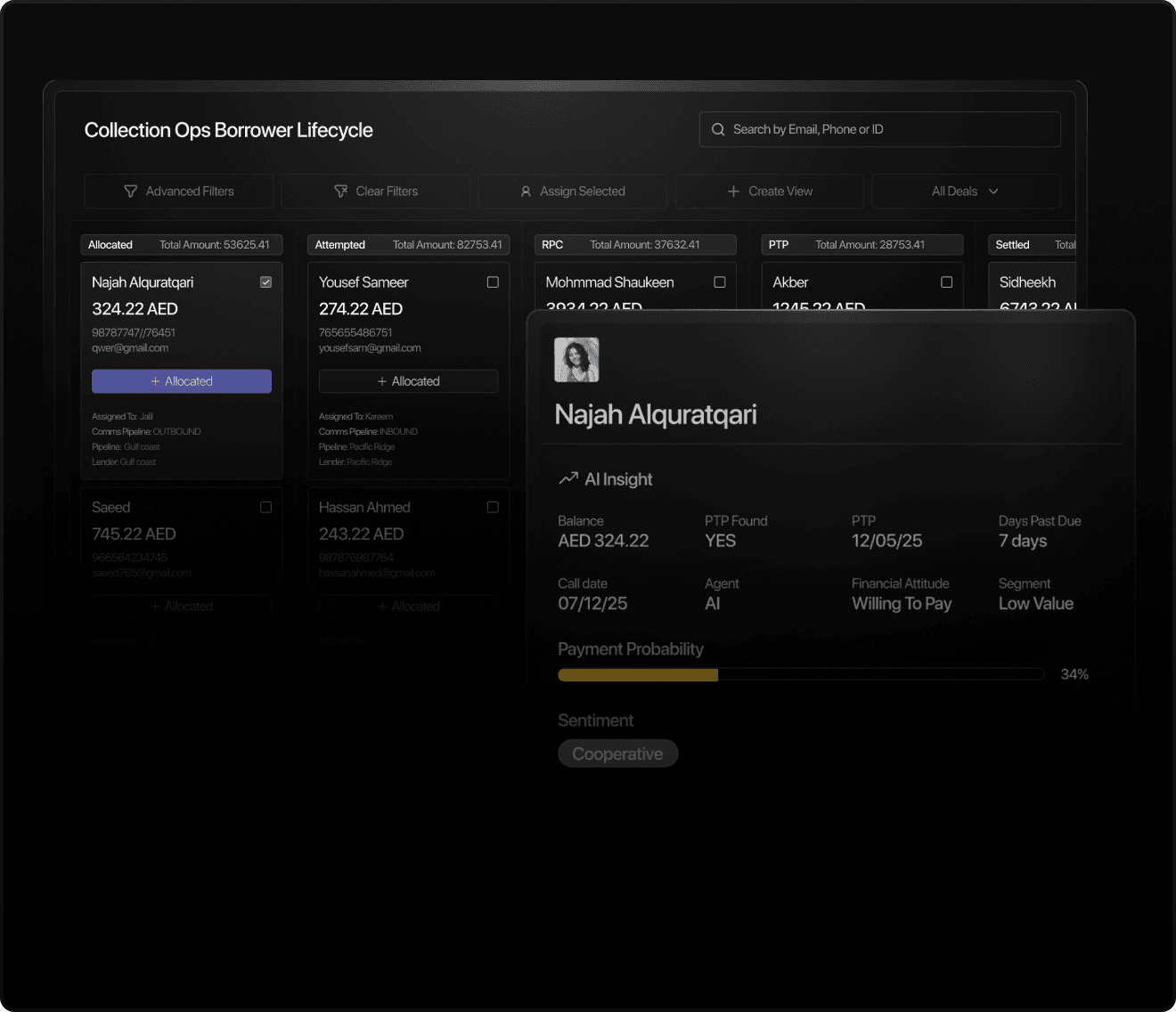

Borrower Trails

Unified history of calls, messages, actions, and PTP events.

Borrower Trails

Unified history of calls, messages, actions, and PTP events.

Borrower Trails

Unified history of calls, messages, actions, and PTP events.

AI Voice Engagement

Generative, compliant voice agents for higher RPC accuracy.

AI Voice Engagement

Generative, compliant voice agents for higher RPC accuracy.

AI Voice Engagement

Generative, compliant voice agents for higher RPC accuracy.

Omni-Channel Communication

Voice, WhatsApp, SMS, email, and in-app outreach.

Omni-Channel Communication

Voice, WhatsApp, SMS, email, and in-app outreach.

Omni-Channel Communication

Voice, WhatsApp, SMS, email, and in-app outreach.

Our Products

Our Products

Our Products

Smarter workflows. Higher recoveries. Real-time operational control.

Solutions

Customer Engagement & Early Resolution

Customer Engagement & Early Resolution

Customer Engagement & Early Resolution

Secure Servicing, Risk Solutions & Portfolio Support

Secure Servicing, Risk Solutions & Portfolio Support

Secure Servicing, Risk Solutions & Portfolio Support

AI Automation & Workflow Intelligence

AI Automation & Workflow Intelligence

AI Automation & Workflow Intelligence

Reporting, Insights & Operational Visibility

Reporting, Insights & Operational Visibility

Reporting, Insights & Operational Visibility

Performance-Driven Recovery & Case Management

Performance-Driven Recovery & Case Management

Performance-Driven Recovery & Case Management

How It works

How It works

How It works

Our AI-powered platform transform your data into actionable insights through a seamless, automated workflow.

Ingest & Organize Data

Real-time ingestion, cleaning, and structuring.

Segment & Prioritize

AI classifies borrowers by behavior and risk.

Engage Automatically

Voice, WhatsApp, SMS, and email orchestrated intelligently.

Drive Resolution

Smart reminders, tailored options, and frictionless settlement.

Monitor Performance

Track results, DPD changes, and strategy effectiveness.

Continuous Learning Loop

AI models improve with every portfolio cycle.

Ingest & Organize Data

Real-time ingestion, cleaning, and structuring.

Segment & Prioritize

AI classifies borrowers by behavior and risk.

Engage Automatically

Voice, WhatsApp, SMS, and email orchestrated intelligently.

Drive Resolution

Smart reminders, tailored options, and frictionless settlement.

Monitor Performance

Track results, DPD changes, and strategy effectiveness.

Continuous Learning Loop

AI models improve with every portfolio cycle.

Ingest & Organize Data

Real-time ingestion, cleaning, and structuring.

Segment & Prioritize

AI classifies borrowers by behavior and risk.

Engage Automatically

Voice, WhatsApp, SMS, and email orchestrated intelligently.

Drive Resolution

Smart reminders, tailored options, and frictionless settlement.

Monitor Performance

Track results, DPD changes, and strategy effectiveness.

Continuous Learning Loop

AI models improve with every portfolio cycle.

Performance Metrics

Performance Metrics

Performance Metrics

38%

Increase in collections

38%

Increase in collections

38%

Increase in collections

2x

Faster resolution time

2x

Faster resolution time

2x

Faster resolution time

60%

Higher engagement rates

60%

Higher engagement rates

60%

Higher engagement rates

4.8

borrower satisfaction score

4.8

borrower satisfaction score

4.8

borrower satisfaction score

Proven across leading banks, BNPL providers, telecom operators, fast-growing digital lenders, and SMEs throughout the GCC region.

Security overview

Security overview

Security overview

ClearGrid is built on UAE-hosted cloud infrastructure with:

ISO 27001:2022

ISO 27001:2022

SOC 2

SOC 2

SAUDI ARABIA PDPL

SAUDI ARABIA PDPL

End-to-end encryption

End-to-end encryption

End-to-end encryption

Role-based access control

Role-based access control

Role-based access control

Data residency compliance

Data residency compliance

Data residency compliance

Structured audit trails

Structured audit trails

Structured audit trails

Secure ingestion pipelines

Secure ingestion pipelines

Secure ingestion pipelines

Operational governance tooling

Operational governance tooling

Operational governance tooling

Your data remains protected, compliant, and fully traceable.

Your data remains protected, compliant, and fully traceable.

Ready to modernize your collections?

Let’s build a faster, more intelligent resolution process together.

Ready to modernize your collections?

Let’s build a faster, more intelligent resolution process together.

Ready to modernize your collections?

Let’s build a faster, more intelligent resolution process together.